Fremont LB840 Goes to a Vote in May

14 Feb 2024

In January, the Fremont City Council unanimously approved submitting the question of adopting the city’s 2024-2039 Local Option Economic Development Plan to registered voters at the May 14 primary election.

The plan calls for the city to spend one-third of collected revenue on each of the following:

- Financing an Economic Development Plan;

- Police and Fire departments;

- Street construction and renovation, including drainage and flood control.

LB840 in Fremont

Fremont citizens have voted to adopt a portion of sales tax revenues from economic development three times. The first was in 1999 when a one-half of one percent sales tax for five years was adopted to fund streets and economic development and the economic development plan. The sales tax was extended in 2004 for ten years to fund street construction and renovation, the Police and Fire Departments, and economic development. In 2014, Fremont voters again extended the one-half of one percent sales tax for ten more years to fund street construction and renovation, the Police and Fire Departments, and economic development equally. The sales tax will expire on December 31, 2024. The current Economic Development Plan runs through 2029.

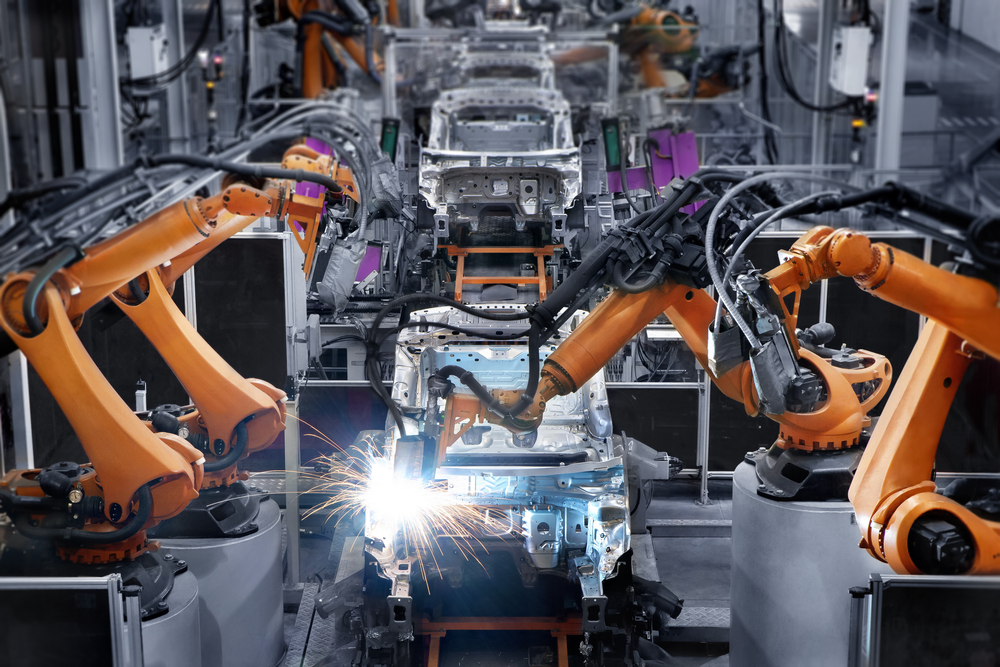

Typical usage of LB840 funds for economic development includes attracting new industries and retaining or expanding existing businesses in Fremont. Funds are offered to eligible businesses in the form of low or 0% interest loans and performance-based forgivable loans (grants), based upon the creation of new jobs and investment in Fremont.

In 2019, GFDC received LB840 funding from the City of Fremont to create the Here We Grow Homes (HWGH) Fund to further expand on the missing middle housing needs of the Fremont community. This program primarily focuses on providing gap financing for developers of low-to-moderate-income housing.

The Greater Fremont Development Council has and continues to assist local businesses with their expansion projects by connecting them to the LB840 program.

What is LB840?

Nebraska Department of Economic Development states, “the Local Option Municipal Economic Development Act (LB840, 1991) authorized incorporated cities and villages — if approved by local voters — to collect and appropriate local tax dollars, including sales and/or property tax, for economic development purposes. To implement an LB840 program, communities formulate a written economic development plan which, if voter-approved, becomes the foundation for the collection and expenditure of local tax revenues for economic development under which the municipality’s LB840 program operates.”

LB840 is a local economic development tool based on the premise that voters of a municipality can choose to spend their tax dollars to meet local development needs. A complete description of the program can be found in the LB840 Program Guide, but in general, a local economic development program may include, but is not limited to, the following activities:

- Direct loans or grants

- Loan guarantees

- Grants for public works essential for the location/expansion of business

- Grants or loans for job training

- The purchase of real estate

- Payments for salary and support of city staff or an outside entity to implement the program

- Bonding used to carry out program activities

More information

The Greater Fremont Development Council can answer any questions residents and businesses have about LB840 and other economic development topics. Contact us today to learn more!

More Topics

Developing Youth Talent Initiative (DYTI) Funding: A Boost for Career Exploration in Fremont, Nebraska

Nov 29 2023